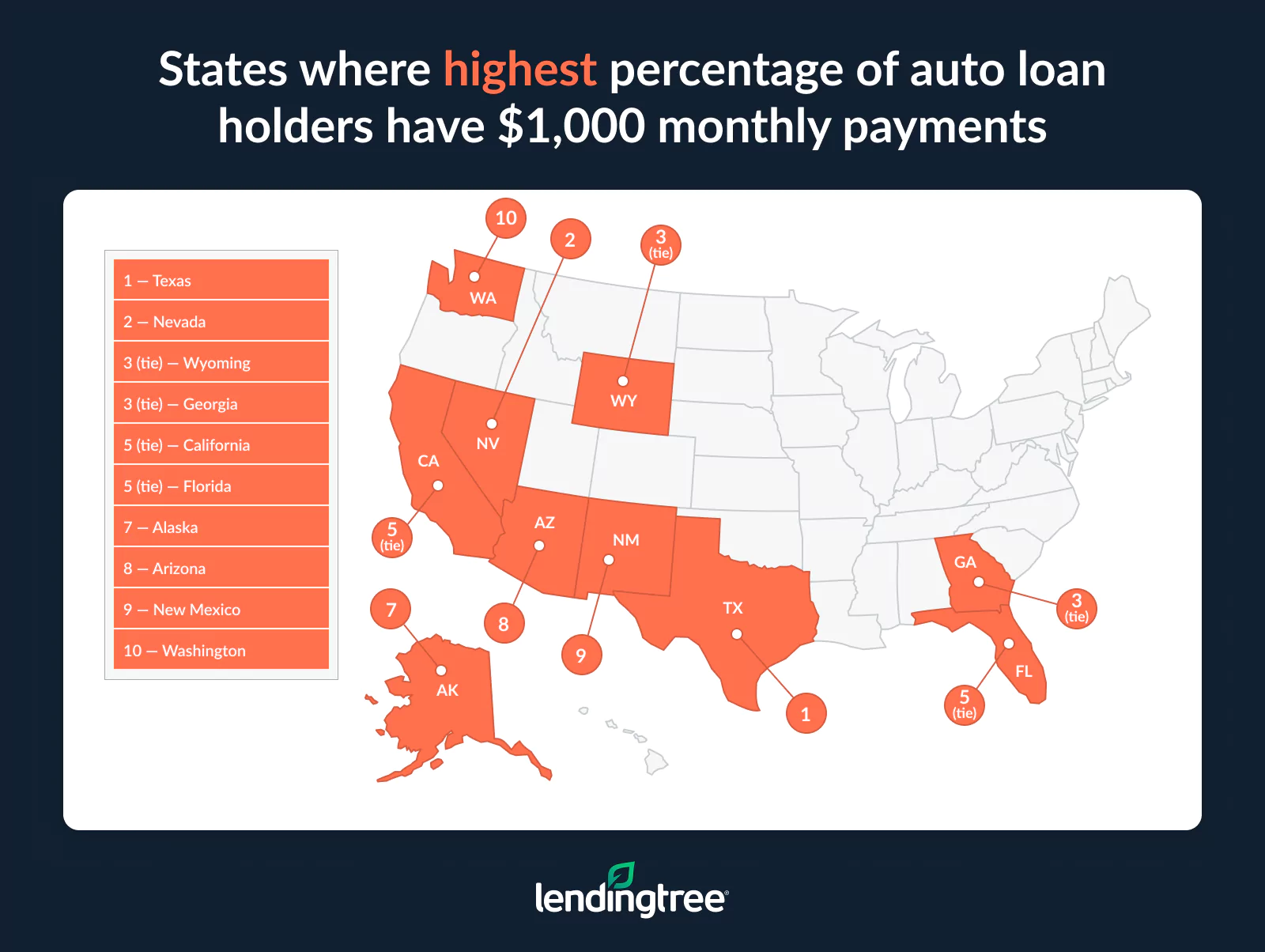

States With Highest Number Of $1K Payments

Nearly one in 10 Americans with auto loans have monthly payments of $1,000 or more on one of them, and 40.3% of those four-digit-payment loans were taken out in 2024 alone.

LendingTree reviewed the anonymized credit reports of about 180,000 Americans with active loans on new or used vehicles and leases in the first quarter of 2025 to see how common four-digit payments are. While these payments are far more the exception than the rule in every state and age group, it’s clear that a large number of Americans took them on last year.

Here’s more on what they found.

Key findings

- $1,000 car payments are more common than you might think. 8.6% of Americans with auto loans for new or used vehicles and leases had at least one monthly payment of $1,000 or more in the first quarter of 2025. A whopping 40.3% of these $1,000-plus payments originated in 2024.

- High car payments are most common in Texas. 12.8% of auto loan holders in Texas have at least one monthly auto payment of $1,000 or more, surpassing Nevada (11.9%) and Wyoming and Georgia (tied at 11.6%). In eight other states, including California and Florida, at least 10.0% of people with auto loans have a $1,000 payment.

- Four-figure car payments are least common in Northeast and Midwest states. Six of the 10 states with the lowest rate of auto loan holders making at least one $1,000 payment are in the Northeast, and four are in the Midwest. Rhode Island has the lowest rate at 4.8%, below Maine (5.1%) and Pennsylvania (5.2%).

- Gen Xers are driving the biggest auto loan payments. 10.8% of Gen Xers with auto loans make at least one payment of $1,000 or more. Baby boomers (8.6%) and millennials (8.0%) follow, versus just 3.2% of Gen Z auto loan holders.

- Higher credit scores are linked to larger auto loan monthly payments. Auto loan holders with super-prime scores of 720 or higher are most likely to have monthly auto loan payments of $1,000 or more (10.4%), while those with deep subprime scores below 580 are least likely at just 5.2%.

$1,000 car payments are more common than you think

It’s a tough time to be in the market for a car. Prices are high — the average cost of a new vehicle is nearly $50,000, according to Kelley Blue Book — and there’s concern that they could increase further due to tariffs. Combine still-high interest rates with this, and things only look worse. Given that volatile mix, perhaps it shouldn’t be surprising that $1,000 car payments are becoming far more common.

In the first quarter of 2025, 8.6% of Americans with auto loans had at least one monthly payment of $1,000 or more. That’s still a relatively small percentage of auto loan borrowers. However, a deeper dive revealed something disturbing: 40.3% of these $1,000-plus-payment loans originated in 2024.

Since the average auto loan term for new and used vehicles ranges from five to six years, that recent spike in four-digit-payment loans means a lot of Americans may be stuck with massive payments for years to come. While many of these loans are taken on by higher-income, wealthier Americans with no concerns about paying off those bills every month, it’s also likely that many others with these loans will struggle in the face of other economic headwinds.

Texas is 4-figure car payment capital of U.S.

In a dozen states, at least 10.0% of people with auto loans have one with a monthly payment of $1,000 or more.

The nation’s three most populous states — California, Texas and Florida — are on that list, but the Lone Star State stands above the rest. In Texas, 12.8% of auto loan holders have one with a four-digit monthly payment, edging out Nevada (11.9%) and Wyoming and Georgia (both 11.6%).